Fabrizio Guidoni | Wall Street Italia | n. 63

Lattanzio Kibs survey analyses the relationship between people and sustainable investment in Italy. Revealing that.

There is a lot of talk about the relationship between Italians and sustainable investments. But where does this relationship stand in concrete terms? In order to provide a meaningful and robust answer, Lattanzio KIBS, an Italian strategy consultancy firm, has drawn up a survey for Wall Street Italia among a sample of 1,616 Italians over the age of 18, representative of residents of Italy's largest cities. The research, designed by Annachiara Annino and elaborated by Luca Cuzzocrea, was developed through a mixed methodology of the Cati/Cawi type (telephone and web interviews), with the aim, precisely, of verifying the opinion of Italians towards sustainable finance. Here is what emerged.

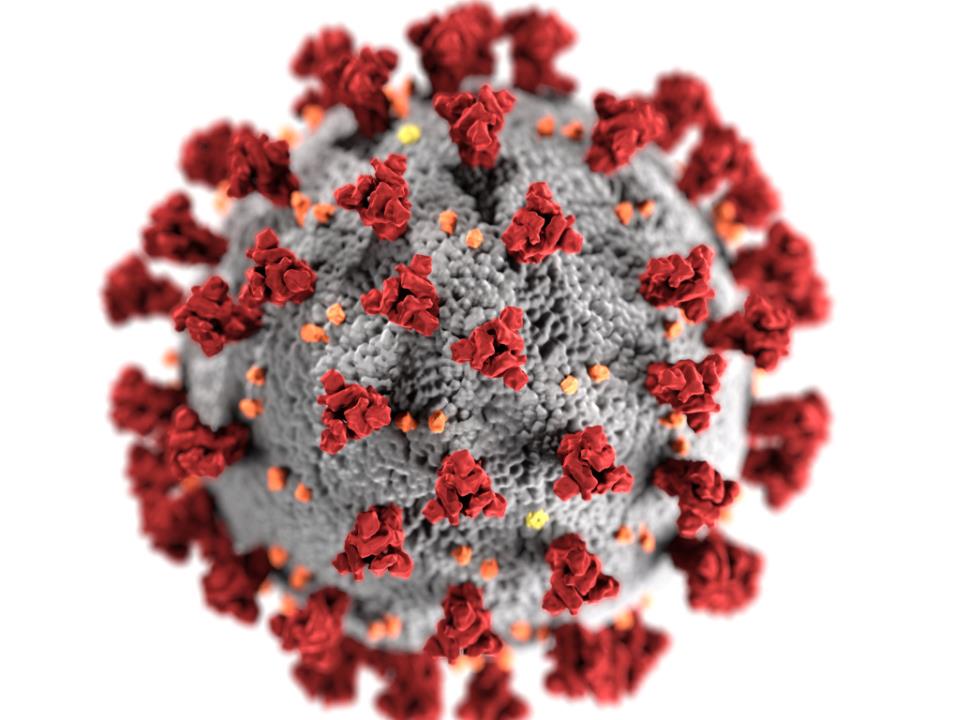

Italians are inclined to invest responsibly. The issue of sustainability has been at the centre of attention for several years now, and indeed, according to the survey, there is a growing trend towards green approaches and behaviour, which the Covid-19 health emergency has only reinforced. This sensitivity is also reverberating in the financial sector, which is increasingly oriented towards sustainability, so much so that today 70% of Italians interviewed would be inclined to make green investments, specifically to buy financial products that invest in companies committed to fighting climate change. More than a quarter of those interviewed say they are convinced of this choice. note, the distribution of consensus decreases almost linearly as age increases. On the other hand, positive attitudes increase with increasing educational qualifications. Among high school graduates and university graduates, the percentage of agreement is three quarters of the sample (around 75%), while among those with a lower qualification, the share stands at 62% and drops to 32% among those without a qualification. A curiosity that emerges from the survey is that Bologna stands out as the greenest city with 79% agreement.

Expectations of returns. While Italians do not seem to have any doubts about the goodness of sustainable financial investment, they do show a greater degree of uncertainty about the returns that such operations can yield (see question 3). Again, this is not a matter of scepticism, limited to a physiological 5%, but of objective difficulty in assessing the opportunities: 21% say they do not know how to answer. Of those who do express an opinion, 40% - a relative majority of the sample - believe that investing in sustainable companies yields more in the long run than investing in companies that are not necessarily sustainable, while 34% believe that it yields the same. So despite a margin of uncertainty, sustainable investing still represents an opportunity that can increase returns. Among those who would buy ethical financial products, the perception of higher returns linked to sustainable companies, i.e. those that care about the environment, the communities in which they operate and the welfare of their workers, is significantly higher (53%).

More financial competence is needed. As is well known, Italians' financial competence is limited, and similarly low when it comes to sustainability issues. The Lattanzio KIBS survey confirms the need for a strong personal and institutional investment in financial education, especially 'ethics', to ensure that the green financial approach of Italian savers is accompanied by a clear awareness of opportunities and limits.

Expectations on the social commitment of companies. A final theme addressed in the study is Italians' attitudes towards the importance of the commitment of companies, whether large or small, to projects in favour of the local area. As before, positive opinions are widespread, reaching a share of 72%. 'The result is not surprising,' conclude the experts from the Italian strategic consultancy firm, 'given that previous studies conducted by Lattanzio KIBS have already shown consumers' desire for a precise and ongoing social commitment on the part of companies. Certainly the health emergency has exacerbated the need, turning it into an urgency. In this case, we register no significant differences in the perceptions of men and women. Furthermore, the analysis of opinions carried out taking into account age shows an increase in the share of 'don't knows' as age increases, against a decrease in positive opinions'.

-576_576.png)

-960_720.jpg)